Silver’s Meteoric Rise

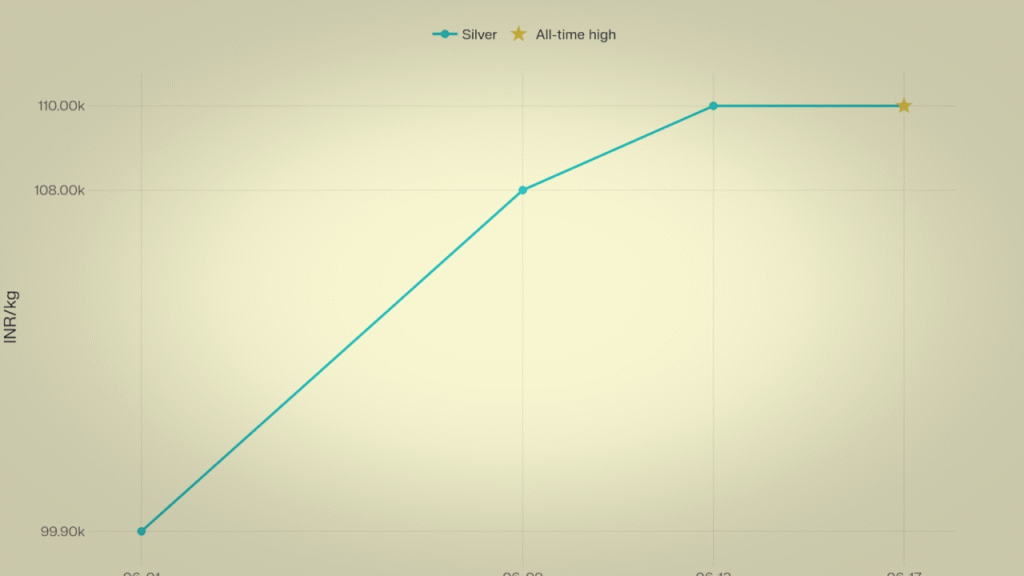

Silver prices on the Multi Commodity Exchange (MCX) soared to an all-time high of ₹1,10,000 per kg on June 17, 2025, marking a 10% jump since the start of the month. This surge outpaced most other commodities and signals a pivotal moment for investors seeking both safety and growth.

What’s Driving Silver’s Rally?

- Geopolitical Tensions: Ongoing conflicts in the Middle East and global uncertainty have pushed investors toward safe-haven assets like silver and gold.

- Industrial Demand: Booming sectors such as solar energy, electric vehicles, and electronics are fueling unprecedented demand for silver.

- Supply Constraints: Delays in new mining projects and tight global supply are amplifying price increases.

- Currency Volatility: A weakening rupee and expectations of global rate cuts are making silver more attractive for Indian investors.

Gold vs. Silver: Which Should You Choose in 2025?

Both gold and silver have reached record highs in 2025, but their investment profiles and outlooks differ. Gold remains the classic safe-haven asset, while silver is gaining momentum due to its industrial demand and potential for higher returns. A balanced approach—allocating to both metals—can help investors optimize growth and manage risk.

Performance Comparison: Gold vs. Silver (2021–2025)

- Gold has delivered steady, strong returns, especially during periods of geopolitical tension and economic uncertainty. In 2024, gold returned 20.8% and is expected to yield 15-18% in 2025.

- Silver has outperformed gold in 2025 so far, surging nearly 23% by mid-year, driven by industrial demand and supply constraints. Over the past three years, silver’s price nearly doubled, with particularly sharp gains in 2025

2025: Why Silver May Outperform Gold

- Industrial Megatrends: Silver’s use in clean energy and EVs is expected to drive long-term demand, with solar energy alone projected to consume a significant share of global silver reserves by 2050.

- Higher Upside, Higher Risk: Silver’s volatility is greater than gold’s, but so is its potential for rapid gains during bull markets and economic recoveries.

- Central Bank Interest: For the first time, central banks like Russia are explicitly adding silver to their reserves, signaling growing institutional confidence.

Gold: The Enduring Safe Haven

- Central Bank Buying: Central banks, especially in emerging markets, continue to accumulate gold, boosting demand.

- Geopolitical Risks: Ongoing conflicts (e.g., Israel-Iran) and global economic uncertainty are pushing investors toward gold.

- Currency Volatility: A weakening rupee and global de-dollarization trends further support gold prices.

Investors View: Gold is expected to remain a portfolio stabilizer and hedge against inflation and currency risk.

Silver: The Industrial Powerhouse

- Industrial Demand: Silver’s use in solar panels, electric vehicles, and electronics is surging, accounting for over 50% of global demand.

- Supply Constraints: Delays in mining projects and a persistent market deficit are amplifying price gains.

- Volatility & Upside: Silver is more volatile than gold, but its potential for rapid gains is higher, especially during economic recoveries.

Investors View: Many analysts and prominent investors (e.g., Robert Kiyosaki, Jim Rogers) see silver as the “hottest investment” of 2025, with the potential to outperform gold due to its industrial relevance and undervaluation

Portfolio Strategy: How Much to Invest?

- Diversification: Experts recommend allocating about 8% of your portfolio to gold and 15% to silver in 2025 for balanced growth and risk management.

- Gold: Best for stability, wealth preservation, and hedging against uncertainty.

- Silver: Offers higher growth potential but comes with greater price swings—suitable for investors seeking higher returns and willing to accept more volatility.

Actionable Strategies for Investors

- Diversify: Balance gold’s stability with silver’s growth potential for a resilient portfolio.

- Stay Informed: Track global events, monetary policy changes, and industrial trends that impact precious metals.

- Consider Silver Stocks: With silver mining companies benefiting from tight supply and rising prices, silver stocks may offer leveraged exposure to the rally.

- Risk Management: Silver’s price swings can be sharp—set clear investment goals and consult a certified financial advisor before making major moves.